As the GFC closes in on its ten year anniversary I’ve been asking myself about the “recovery”. Or lack thereof.

In order to kickstart the economy again after it almost completely fell over (that is another story completely) central banks embarked on long periods of easy monetary policy. This consisted of extreme money printing, and very low (even negative) interest rates. We are still in the middle of this almost ten years on.

Printing of paper currency out of thin air decreases the value of that currency. There is simply no other result possible. You cannot dilute something and expect each unit to hold the same value. On top of this, central banks are actively trying to devalue their currency against others to boost their own economy.

The result of this, is that all paper currencies are weakening at the same time. Therefore, on the face of it, this weakening cannot be seen by looking at exchange rates. Do not be fooled though, as stated above, the only possible result from diluting the money supply is a weaker currency. In real terms as well as comparative to other paper currencies. This implies that it should take more paper currency to buy the same amount of goods than before the GFC. However, this hasn’t happened (at least not to the extent expected given the magnitude of the money printing).

So, why hasn’t it happened?

The answer is the velocity of money. This new money has not found its way through the economy and to the consumer yet. This money can, however, be seen in the form of high asset prices. We are in the midst of long running bull markets in stocks, bonds and house prices. Historically, these markets do not all rise together. However, with all the additional money available, it needs to be invested somewhere in order to generate a return on it. Therefore, I think we are seeing asset prices inflated due to the abundance of easy money.

What next?

Something has to give. Paper currency cannot continue to be devalued without anything else happening. Remember, paper currency is not backed by anything other than the government that issues it. The same governments that have been printing all this money (hence amounting huge piles of debt). Paper currency becomes worthless (or worth a lot less) when these debt laden governments lose credibility and cannot continue to support the value of the currency.

The result? Inflation. And potentially lots of it. Inflation means the purchasing power of the paper currency reduces. The value of the paper currency goes down.

It seems counterintuitive that central banks are striving to see inflation. They have essentially caused massive inflation by diluting the paper currency supply. It just hasn’t hit the consumer yet.

Where to from here?

The only answer I have right now is gold. All paper currency used to be backed by gold. Every paper dollar used to backed by physical gold. On top of that gold has been used as currency for thousands of years. So why did we ever move away from it?

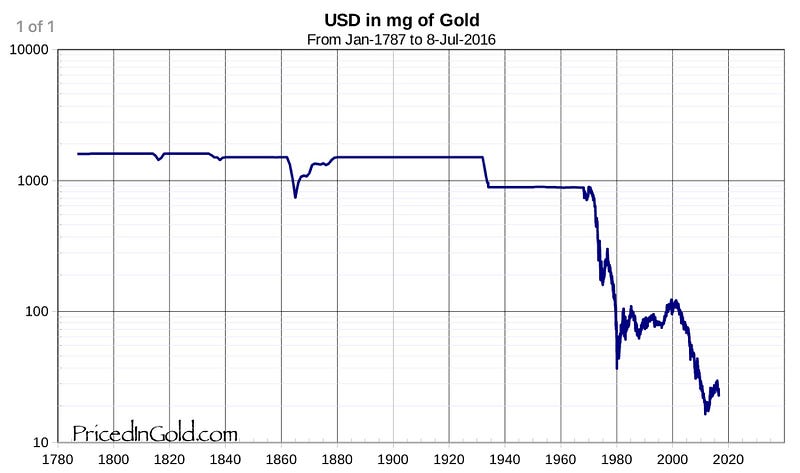

The first thing people think of is the price of gold in US dollars. However, given all the things I have described above, it is more appropriate to consider the value of paper currency in terms of gold. Gold is the currency with thousands of years of history behind it. It is this relationship that has been trending down for a long time.

The key step change was when paper currency moved away from gold backing in the 1970s. That is, paper currency no longer tied to a certain amount of gold. It just became paper. It is no coincidence that when this happened we started seeing these large reductions in the value of the dollar in terms of gold. Central banks had the freedom to intervene with their currencies.

The common argument is that gold is useless and outdated as a currency. However, in the increasingly complex fiscal system we operate in it is the one thing that has remained simple and backed up by history.

The following graph is credit to pricedingold.com. It shows how much gold a US dollar can buy over time.

One very strange anomaly is that during the money printing days post 2011, the dollar strengthened against gold. This is completely counterintuitive. Paper currency was being heavily diluted, yet it was buying more gold than previous years when there was less paper currency.

The explanation lies in the fact that currently the price of gold is quoted based on the futures market. That is, paper contracts and not real gold. Therefore the demand for actual physical gold does not necessarily relate to the price quoted. That is completely different from everything else. If there is an egg shortage, the price of eggs will go up, and vice versa. This is currently not the case with gold pricing. No eggs are required to change hands once the contract expires, therefore, the price of that particular market does not feel a shortage or oversupply. This mismatch cannot continue indefinitely and the price of gold will have to reflect the demand/supply of the physical metal and not paper contracts. A physical gold exchange (not paper contracts) will emerge because buyers of gold want physical gold and not paper.

We are seeing a turnaround in the price of gold vs the US dollar currently, and the fundamental reasons I outlined suggest this could be a long bull market. With so much more paper money, and still (comparatively similar) amounts of gold, the price has to tend to balance this out by increasing significantly past previous highs.

Eastern countries such as Russia and China (governments) have been large buyers of physical gold over recent years. They seem to be moving away from holding US dollars. Maybe these countries are ahead of the game and have already foreseen what I outlined above. These countries will soon become the price makers for physical gold. There is already a gold exchange in Shanghai. The paper gold markets of the west cannot continue the way they are.

The devaluing of paper currency and potential need for a replacement makes for very interesting times. My bet is gold will have an increasing part to play, as it has throughout history. It is the only currency that has stood the test of time and cannot be manipulated. If money was money and didn’t cause it’s own problems we could concentrate on economic growth.

Conclusion

For the reasons that I have outlined above it is possible that we are coming to the end of paper currency as we know it. The money supply cannot continue to be diluted without causing mass inflation and loss of confidence in paper currency. I expect that currencies will need to be rebased to something physical, like gold (or maybe Bitcoin or something we don’t know about yet). The timeframe for this is anyone’s guess, but the factors have been in play for a long time, and the ten years post-GFC could be leading towards the endgame. Our fragile financial system could produce the catalyst that puts the wheels in motion. Ultimately, whatever happens, I can see a strong future for gold, and gold prices could move to levels unseen and maybe unthought of. Gold is the oldest currency and maybe that is for a good reason.

YoBit allows you to claim FREE CRYPTO-COINS from over 100 distinct crypto-currencies, you complete a captcha one time and claim as much as coins you want from the available offers.

ReplyDeleteAfter you make about 20-30 claims, you complete the captcha and proceed to claiming.

You can click claim as much as 30 times per one captcha.

The coins will stored in your account, and you can convert them to Bitcoins or USD.